ELECTIONS 2024

This is a historic week as South Africa prepares to head to the polls on 29 May for the seventh time since the dawn of democracy 30 years ago. Investors, financial analysts and policymakers are closely monitoring the political landscape to gauge potential outcomes and their subsequent impact on economic policies, investor confidence, and market dynamics.

This week’s elections are expected to be the most widely contested yet, with uncertainty about whether the ruling ANC will obtain an overall majority nationally. The potential of a coalition government introduces additional risks to implementing coherent and effective policy reforms that are desperately needed in the South African economy. Economic policies require stability and predictability.

Consequently, markets tend to react negatively to political instability and uncertainty, which are more common in coalition governments. This has been showcased recently in the inefficiencies that have been experienced in the various Metros around the country that are being governed by a coalition of political parties.

So, how do financial markets behave in periods leading up to significant events such as elections that have potential to increase political risk?

History

Previous South African general elections have not generally driven significant market volatility. The election outcomes themselves were widely predicted and were deemed unlikely to result in any significant shift in overall policy direction. That is not so clearly the case this time around.

Perhaps a better lens through which to examine today’s uncertainty is to examine those moments when the ANC itself has undergone periods of turbulence, such as during contested leadership elections or moments such as “Nenegate” in December 2015, when then-President Jacob Zuma unexpectedly dismissed Finance Minister Nhlanhla Nene, replacing him with the relatively unknown David van Rooyen, increasing the market’s perception of political risk.

How do we measure the market’s pricing of political risk?

The prices of financial instruments incorporate a wide range of information and multiple risk factors, as well as the prevailing macro-economic environment.

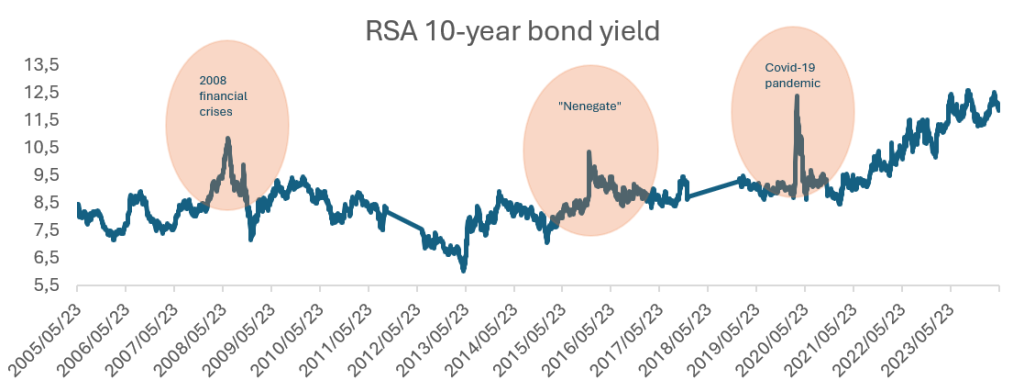

To assess the ‘riskiness’ of South African financial markets and assets, we can look at movements in bond yields, which reflect the cost of borrowing for the South African government through the issuing of government bonds. Political outcomes that are regarded by the market as negative will lead to investors requiring a higher risk premium to lend money to South Africa and a consequent spike in the yields of South African bonds to reflect this increased risk. If we look historically by referring to the 10-year government bond yield curve presented below, the most notable spikes in yields occurred during the 2008 global financial crisis, during ‘Nenegate’, and at the start of the COVID19 pandemic in March 2020.

Changes in the performance of the Rand over time would also mirror the volatility caused by the same events that caused a selloff in South African bonds.

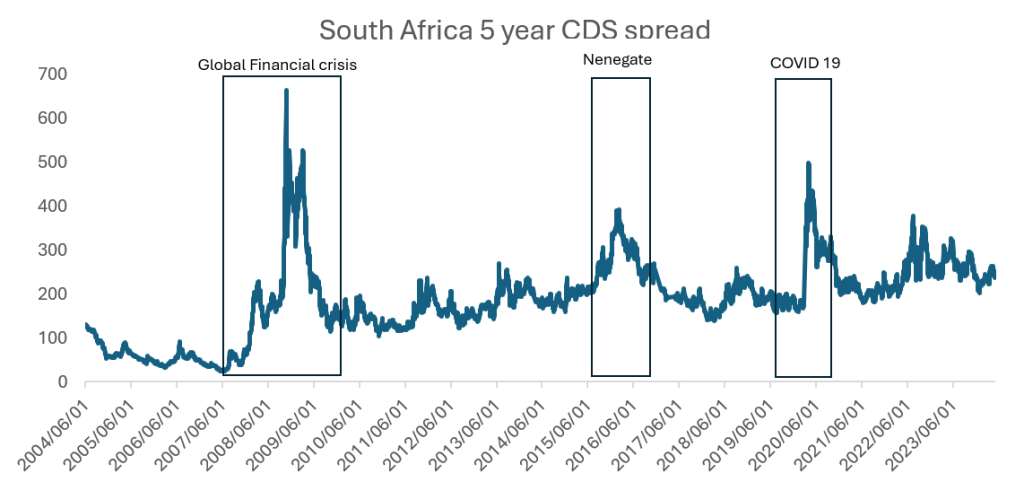

Finally, we can look to Credit Default Swap (CDS) spreads. CDSs function as a form of insurance against the default of a borrower, with the spread of a CDS reflecting the cost of this insurance and higher spreads indicating a higher perceived risk of default. The spreads of South African CDSs will move over time and reflect changes in the probability of South Africa defaulting and the subsequent cost of buying protection. CDS spreads are also affected by the global economic environment, currently characterised by increased geo-political uncertainty and tightening monetary policies in major economies, that has led to a higher risk premium for emerging markets, including South Africa. As we head into an election, increased uncertainty about the outcome and the future direction of economic policy might cause CDS spreads to widen as investors perceive higher risk.

How have markets reacted to political risk events and elections uncertainty

Political risk arises from political events that result in instability or uncertainty. These include elections when the outcome is uncertain, policy announcements that are perceived as market-unfriendly, and finally abrupt leadership changes or scandals that raise concerns over stability and governance.

General elections in South Africa have not previously driven significant political risk because outcomes were relatively certain, making policy trajectory predictable. ANC elective conferences, on the other hand, which determine the leadership of the ANC, have been far less certain and have arguably had more profound implications for the country’s political and economic policy direction.

South Africa’s CDS spreads have shown significant movement during periods when these elections have taken place. The graph below shows how South Africa’s 5 years CDS spreads have moved over time. A summary is provided for how those CDS spread moved around at the time of ANC elective conferences from 2007 to 2022.

2007

Jacob Zuma being elected as the ANC president, marked a significant political shift. Zuma’s victory was seen as a turning point, introducing concerns about policy stability and governance.

Leading up to and following the conference, there was noticeable volatility in South Africa’s CDS spreads. Investors were cautious about the potential for increased populism and shifts in economic policies under Zuma’s leadership.

2012

Jacob Zuma re-elected as the ANC president, defeating Kgalema Motlanthe. This period was marked by internal party conflicts and debates over economic policy directions.

CDS spreads showed a tendency to widen due to uncertainties about the continuity of economic policies and the increasing factionalism within the ANC. Investors were particularly concerned about the impact of potential policy changes on South Africa’s economic stability.

2017

Cyril Ramaphosa was elected as the ANC president, defeating Nkosazana Dlamini-Zuma. This election was seen as a potential turning point towards more market-friendly policies and anti-corruption measures.

Leading up to the conference, CDS spreads were relatively high, reflecting investor concerns about the potential continuation of Zuma’s economic policies and governance style if Dlamini-Zuma won.

Following Ramaphosa’s victory, CDS spreads narrowed, indicating increased investor confidence in potential economic reforms and efforts to tackle corruption.

2022

Re-election of Ramaphosa was seen as a positive development by markets, given his commitment to reforms and anti-corruption measures. Ho0wever, the ANC remains deeply divided.

Financial markets viewed Ramaphosa’s victory as a stabilizing factor for South Africa’s political and economic landscape.

CDS spreads narrowed following the victory, reflecting optimism about continuity in improving governance and economic management under Ramaphosa.

2024 General elections – What are the polls indicating?

Based on the most recent opinion polls, this week’s general elections are expected to be the most closely contested yet. The big uncertainty is whether the ANC will secure a majority vote and, should it fail to do so, the potential that it will enter a coalition with parties that promote less market friendly policies.

What are the election outcome scenarios for the markets?

The election result scenario where the ANC performs very poorly (close to 40% of the total vote) will likely result in an immediate increase in volatility and a sell-off in the Rand and bonds until the permutations of the coalition arrangements are finalised. This weakness could extend longer depending on the nature of coalition partnerships that are concluded, especially if agreements are reached with parties that are perceived to be less market friendly. The position could easily become complex with regional results such as those in Gauteng and KwaZulu-Natal particularly influential in determining the outcome.

2024 General elections – What are the markets predicting?

However, market trends show increased conviction that the ANC will win enough votes to obtain close to a majority vote or lead a coalition of smaller parties that are more aligned to its existing policies. This is reflected in the positive trends in bonds yields and the exchange rate, with the Rand at a near nine-month high against the US Dollar (currently trading at 18.42 ZAR to the US Dollar). This outcome would result in an immediate positive reaction from markets with the focus then returning to the local and macro-economic factors.

Update

Coalition scenarios driving market volatility

Last night, the IEC announced the 2024 election results confirming that ANC has lost the majority vote, gaining 40% of the total national vote. This outcome is worse than it had been predicted based on the relatively positive sentiment in the markets in the run up to the elections.

This outcome leaves the ANC with less options for coalition partners and with somewhat reduced bargaining power when it comes to the final coalition agreements. The markets remain volatile, with the rand having sold off up to R18.71 to the US dollar on Friday as the results were coming in.

The source of uncertainty in the markets has been the scenario where the ANC enters into a coalition arrangement that risks policy continuity. Finance minister Enoch Godongwana commented that the ANC won’t be “reckless” in choosing coalition partners and there will be policy continuity. The markets will continue to trade cautiously over the next week until the coalition arrangements are finalised.